Most people don't keep 100 percent of their retirement savings in a single investment, however. Treasury bills, a proxy for what you might get from a bank deposit, have returned about 3 percent a year. Bonds have earned an average 5.33 percent a year over the same time. According to Morningstar, stocks have earned an average 10.29 percent a year since 1926 - a period that includes the Great Depression as well as the Great Recession. We can look at long-term historical returns to get some ideas. No one knows what stocks, bonds or bank certificates of deposit will earn in the next 20 years or so. 2: How much will you earn on your savings? Some people want to leave their entire savings to their children or the church of their choice - which is fine, but it requires a much higher savings rate than a plan that simply wants your money to last as long as you do. All told, the average couple will need $295,000 after taxes to cover medical expenses in retirement, excluding long-term care, according to estimates from Fidelity Investments.įinally, there's the question of how much, if anything, you wish to leave to your children or charity. You also have to pay 20 percent of the Medicare-approved amount for doctor's bills as well as a $203 deductible. The standard monthly premium for Medicare Part B, which covers most doctors’ services, is $148.50 or higher, depending on your income. Medical care is another expense that people in retirement often don't factor in.

“They want to take a four-week trip somewhere, maybe pay business class to get there, and it can cost $20,000 or so.” That's not a problem, Bass says, as long as you build it into your budget and the trip doesn't end in the poorhouse.

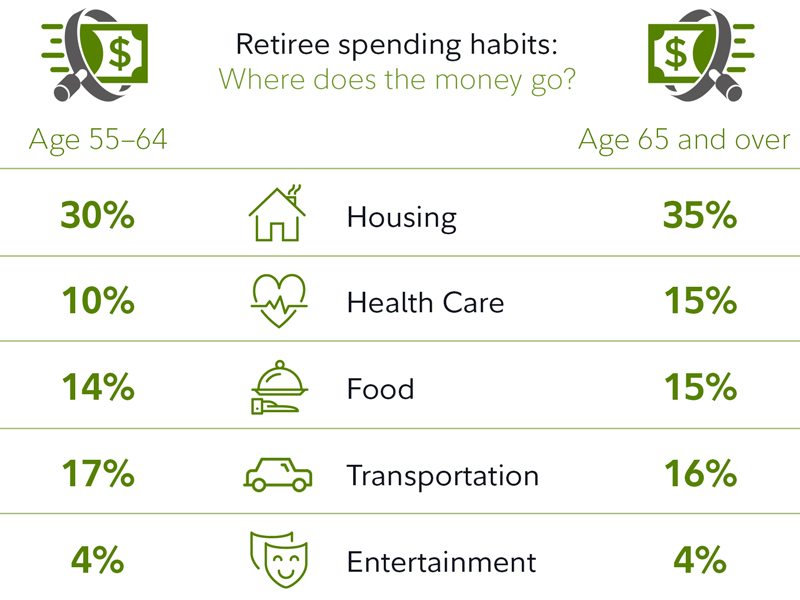

“In the first three years of retirement, the biggest expense is often travel,” says Mark Bass, a financial planner in Lubbock, Texas. This calculation doesn't consider other things you might want to spend money on. Bear in mind, however, that any withdrawals from a tax-deferred savings account, such as a traditional IRA or a 401(k) plan, would be reduced by the amount of taxes you pay. If you and your spouse will collect $2,000 a month from Social Security, or $24,000 a year, you'd need about $16,000 a year from your savings. If your annual pre-retirement expenses are $50,000, for example, you'd want retirement income of $40,000 if you followed the 80 percent rule of thumb. You also need to factor in any pension or Social Security income you'll be getting. In addition, you'll save on the usual costs of going to work - the pandemic won't keep everyone at home forever - such as new clothing, dry cleaning bills, commuting expenses and the like. The 80 percent rule comes from the fact that you will no longer be paying payroll taxes toward Social Security (although you may have to pay some taxes on your Social Security benefits), and you won't be shoveling money into your 401(k) or other savings plan. The rule of thumb is that you'll need about 80 percent of your pre-retirement income when you leave your job, although that rule requires a pretty flexible thumb. Weigh these four factors to get a better handle on how much money you will need to retire. You'll need to revisit your retirement formula once or twice a year to make sure it's on track, and be prepared to make adjustments if it isn't. The retirement equation isn't unsolvable, but it's not a precise calculation, either. “If X equals your spending in retirement, Y equals your rate of return and Z equals the number of years you will live, how much will you need to save, given that X, Y and Z are all unknowable?" En español | Figuring out how much money you need to retire is like one of those word problems from high school that still haunts you.

0 kommentar(er)

0 kommentar(er)